Inflation Rate Australia 2025 To 2025 Forecast

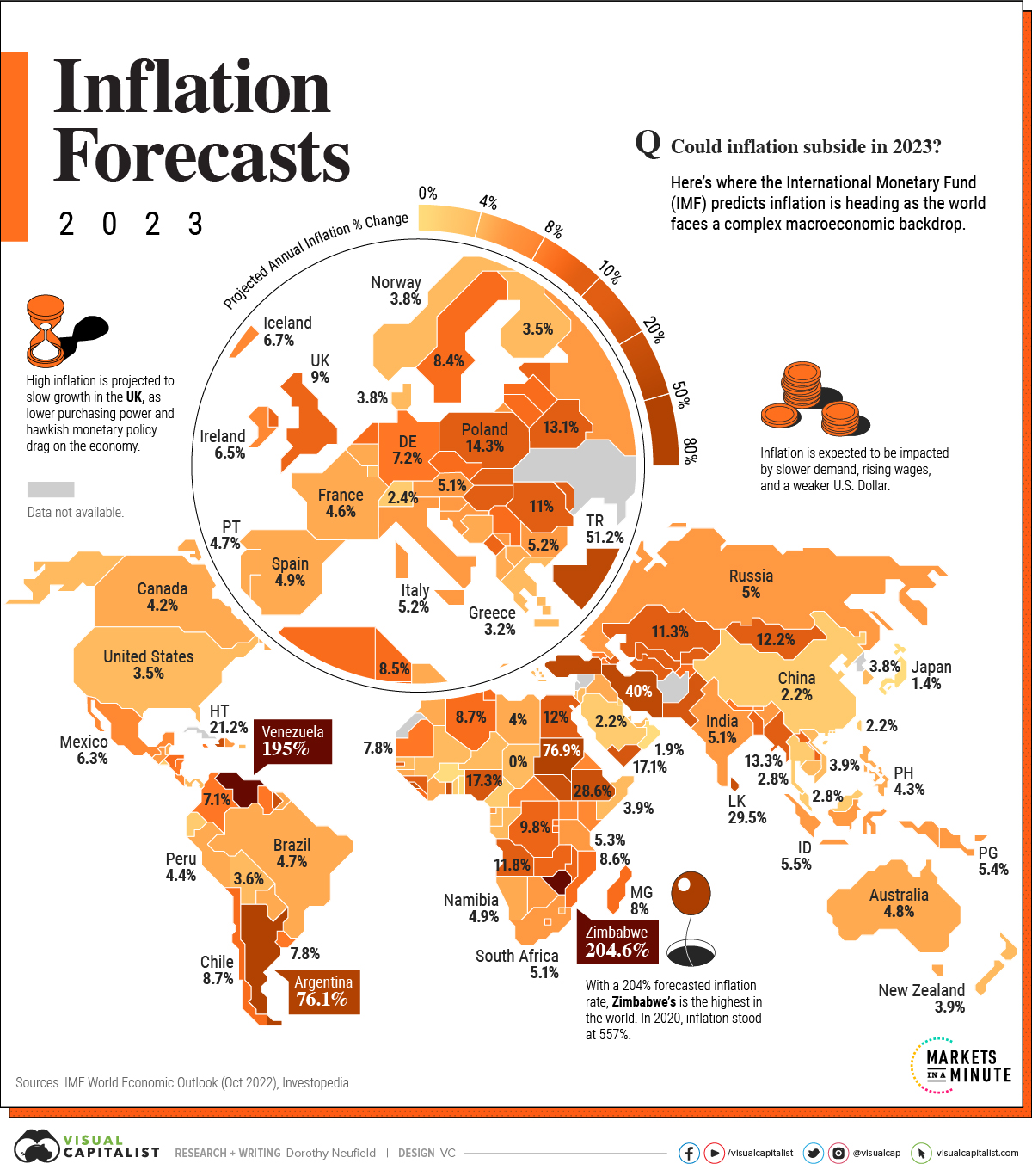

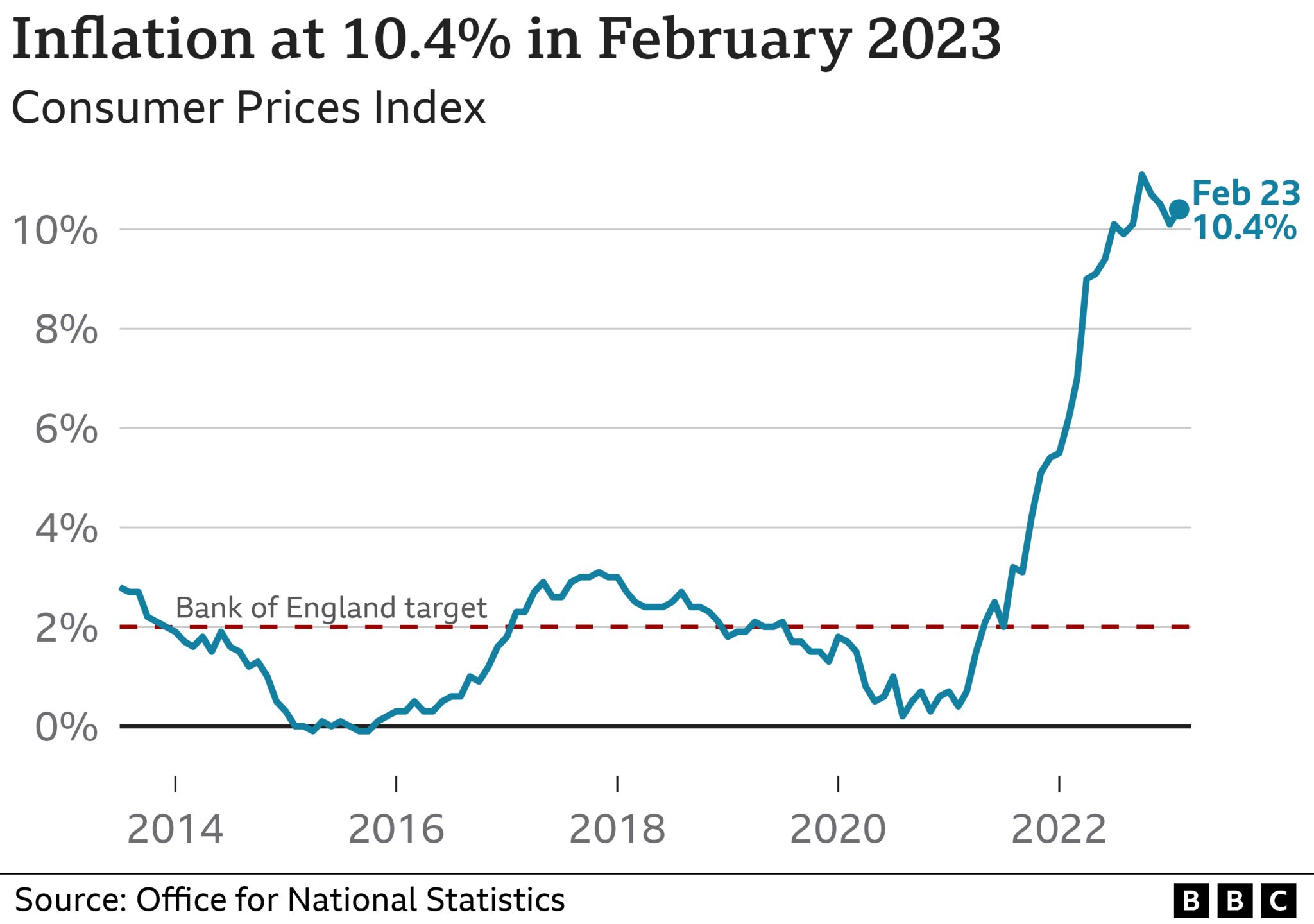

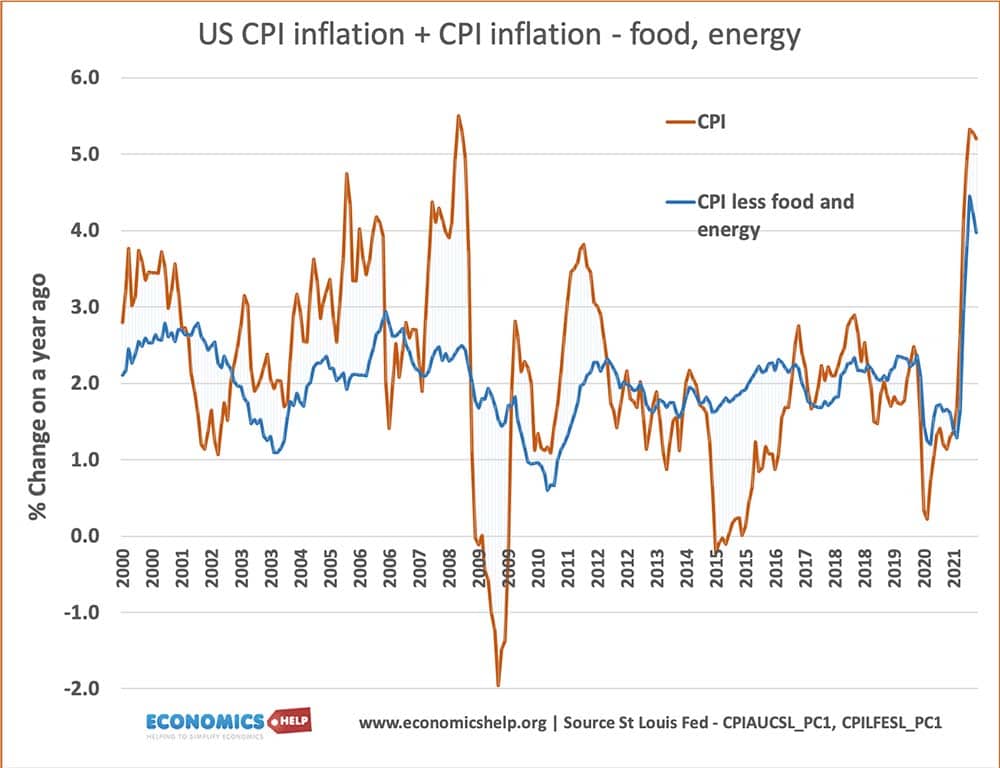

Inflation Rate Australia 2025 To 2025 Forecast. Inflation is forecast to decline to around 3¼ per cent by the end of 2025, and to be within the target range at 2¾ per cent by the end of 2025. The national australia bank (nab) estimated inflation at 6.9% in the first quarter of 2023, as of 9 november 2022 forecast.

Westpac and anz both predict a may 2025 timeline for the first rate cut, citing expectations of easing inflation pressures by early 2025. Price rises would ease further in 2025 but were at the mercy of interest rate cuts and the rba.

Inflation Rate Australia 2025 To 2025 Forecast Images References :

Source: jameshughes.pages.dev

Source: jameshughes.pages.dev

Australia'S Current Inflation Rate 2025 James Hughes, Have business profits contributed to inflation?

Source: liamdowd.pages.dev

Source: liamdowd.pages.dev

Inflation Rate 2025 Australia Liam Dowd, The latest value from 2028 is 2.42 percent, a decline from 2.51 percent in 2027.

Source: chloecoleman.pages.dev

Source: chloecoleman.pages.dev

Current Inflation Rate 2025 Australia Chloe Coleman, Well, that looks to be driven by the decrease in australia's trimmed mean inflation.

Source: ellawalker.pages.dev

Source: ellawalker.pages.dev

Current Australian Inflation Rate 2025 Ella Walker, This table provides additional detail on forecasts of key macroeconomic variables as at the may 2023 statement on monetary policy.

Source: christopheravery.pages.dev

Source: christopheravery.pages.dev

Current Inflation Rate 2025 Australia 2025 Christopher Avery, Have business profits contributed to inflation?

Source: williammackenzie.pages.dev

Source: williammackenzie.pages.dev

Current Inflation Rate Australia 2025 Usd William Mackenzie, Inflation rate in australia decreased to 2.80 percent in the third.

Source: ellawalker.pages.dev

Source: ellawalker.pages.dev

Current Australian Inflation Rate 2025 Ella Walker, In april, it was forecasting australia's annual rate of headline inflation to be 2.83 per cent by the end of 2025, but it has revised that figure up to 3.6 per cent.

Source: williamshort.pages.dev

Source: williamshort.pages.dev

Australia Cpi 2025 Annual William Short, Have business profits contributed to inflation?

.png) Source: maryclarkson.pages.dev

Source: maryclarkson.pages.dev

Current Inflation Rate 2025 Australia And New Mary Clarkson, The national australia bank (nab) estimated inflation at 6.9% in the first quarter of 2023, as of 9 november 2022 forecast.

Source: www.reuters.com

Source: www.reuters.com

Australia's surprisingly strong Q3 inflation raises odds of Nov rate, Price rises would ease further in 2025 but were at the mercy of interest rate cuts and the rba.

Category: 2025